CO DoR DR 0563 1994 free printable template

Show details

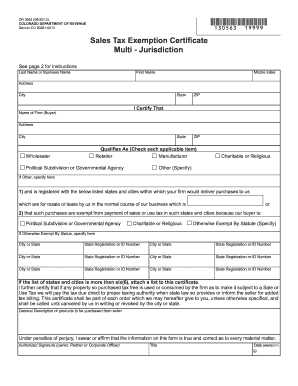

DR 0563 (2/94) COLORADO DEPARTMENT OF REVENUE 1375 SHERMAN STREET DENVER CO 80261 SALES TAX EXEMPTION CERTIFICATE MULTI JURISDICTION See reverse side for Instructions. Address Issued to (Seller) Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your colorado resale certificate 1994 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado resale certificate 1994 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing colorado resale certificate 1994 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit colorado resale certificate 1994. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

CO DoR DR 0563 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out colorado resale certificate 1994

How to fill out colorado resale certificate 1994:

01

Retrieve the Colorado Resale Certificate 1994 form from the Colorado Department of Revenue website or obtain a physical copy from a local tax office.

02

Ensure you have all the necessary information handy, including your business name, address, and your Colorado Account Number.

03

Begin by completing the top section of the form, providing your business information and indicating the filing period.

04

Provide your Colorado Account Number and federal employer identification number (FEIN) in the appropriate fields.

05

Fill in the purchaser's name and address if applicable. If the purchaser is from another state, include their out-of-state registration or account number.

06

Specify the type of tangible personal property being purchased or rented by checking the appropriate box.

07

Indicate whether the property is solely for resale or for both resale and use.

08

Sign and date the certificate at the bottom, certifying that the information provided is accurate and complete.

09

Retain a copy of the completed certificate for your records.

Who needs colorado resale certificate 1994:

01

Retailers and businesses in Colorado who purchase tangible personal property for the purpose of resale.

02

Individuals or entities who engage in wholesale, retail, or leasing activities and need to document their exemption from paying sales tax on certain purchases.

03

Any business that sells goods to other businesses for resale purposes within the state of Colorado.

Fill form : Try Risk Free

People Also Ask about colorado resale certificate 1994

Does a District of Columbia resale certificate expire?

Is a Colorado sales tax license the same as a tax-exempt certificate?

Does Colorado resale certificate expire?

Does Colorado have a resale certificate?

Does Colorado exemption certificate expire?

How do I verify my resale certificate in Colorado?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is colorado resale certificate form?

The Colorado resale certificate is a form that allows a purchaser to buy goods for resale without paying sales tax at the time of purchase. It is a valid exemption certificate that relieves the seller from the obligation of collecting sales tax on the transaction, provided the buyer will resell the purchased item and collect sales tax from their customers. The resale certificate must be filled out and signed by the purchaser, and it typically requires the buyer's name, address, Colorado sales tax license number, and specific details about the transaction.

Who is required to file colorado resale certificate form?

In Colorado, the individuals or businesses required to file a resale certificate form are retailers and sellers who purchase items for resale. The resale certificate allows them to make tax-exempt purchases for goods that will be resold. This form is used to document and verify their tax-exempt status.

How to fill out colorado resale certificate form?

To fill out the Colorado Resale Certificate form, follow these steps:

1. Obtain the form: The Colorado Resale Certificate form can be downloaded from the Colorado Department of Revenue's website or obtained from your local office.

2. Provide your information: Enter your name, address, and contact details at the top of the form. This information should match the details on your business license or registration.

3. State the reason for exemption: In section 1, you need to indicate the reason for exemption from paying sales tax. Typical reasons may include purchasing goods for resale, manufacturing, or wholesale distribution. Select the applicable reason from the provided options.

4. Provide your business information: Section 2 requires you to provide your Colorado Account Number, Retail Sales License Number, and Federal Employer Identification Number (FEIN).

5. Seller information: Enter the seller's name, address, and contact details in section 3. This information should match the details provided by the seller on their invoice or sales documentation.

6. Product description: In section 4, provide a detailed description of the products or materials being purchased for resale. Include the quantity, unit price, and total amount for each item.

7. Signature and date: Sign and date the form in section 5 to certify that the information provided is accurate and that you understand the consequences of providing false information.

8. Retain a copy: Make a copy of the completed form for your records. It's recommended to keep all resale certificates for at least four years in case of an audit.

9. Submit the form: Submit the original completed form to the seller when making your purchase. The seller may keep the certificate on file to validate the sales tax exemption.

Note: It's essential to consult with a tax professional or refer to the Colorado Department of Revenue's guidelines for specific instructions and to ensure compliance with any updates or changes in the requirements.

What is the purpose of colorado resale certificate form?

The purpose of the Colorado Resale Certificate form is to allow businesses to purchase items or services for resale without paying sales tax. This form certifies that the purchaser intends to resell the items and will collect sales tax from their customers when the items are sold. It is used to provide evidence to vendors that the purchaser is eligible for tax exemption on certain purchases.

What information must be reported on colorado resale certificate form?

When reporting on a Colorado resale certificate form, the following information must be included:

1. Seller's name and address: Provide the complete legal name and physical address of the seller.

2. Buyer's name and address: Give the complete legal name and physical address of the buyer.

3. Colorado sales tax license number: Include the sales tax license number assigned to the buyer by the Colorado Department of Revenue.

4. Description of the property being purchased for resale: Clearly state the type of goods or property that the buyer plans to resell.

5. Reason for claiming resale exemption: Explain why the buyer believes they qualify for a resale exemption (e.g., purchasing for resale, using for manufacturing or processing, etc.).

6. Buyer's signature and date: The buyer or an authorized individual should sign and date the resale certificate form.

Please note that the specific requirements and layout of the Colorado resale certificate form may vary, so it is recommended to refer to the official form provided by the Colorado Department of Revenue for accurate and up-to-date information.

What is the penalty for the late filing of colorado resale certificate form?

According to the Colorado Department of Revenue, there is no specific penalty outlined for the late filing of a resale certificate form. However, it is important to file the form on time to avoid any potential issues or complications related to sales and use tax reporting. It is recommended to contact the Department of Revenue directly for further clarification on any potential penalties.

How can I get colorado resale certificate 1994?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the colorado resale certificate 1994 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit colorado resale certificate 1994 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing colorado resale certificate 1994.

How do I edit colorado resale certificate 1994 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share colorado resale certificate 1994 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your colorado resale certificate 1994 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.